Key Components of Successful W Pattern Trading

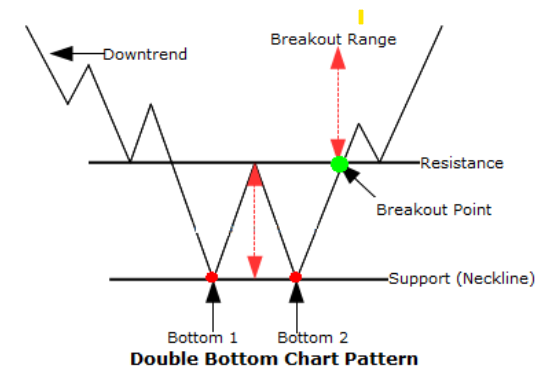

Successful W pattern trading requires careful attention to several critical components that distinguish high-probability setups from false signals. The neckline, which connects the peak between the two lows, serves as the primary resistance level that must be broken for pattern confirmation. This breakout typically occurs with increased volume, signaling renewed buying interest and momentum shift.

Time frame analysis plays a vital role in W pattern effectiveness. Patterns forming on higher time frames, such as daily or weekly charts, generally carry more significance than those on shorter intraday charts. The duration between the two lows also matters – patterns that develop over several weeks or months tend to be more reliable than those forming within a few days.

Risk management becomes paramount when trading W patterns. Successful traders typically place stop-loss orders below the pattern's lowest point, while profit targets are often calculated by measuring the distance from the lows to the neckline and projecting that distance above the breakout point. This approach provides a favorable risk-to-reward ratio that enhances long-term profitability.